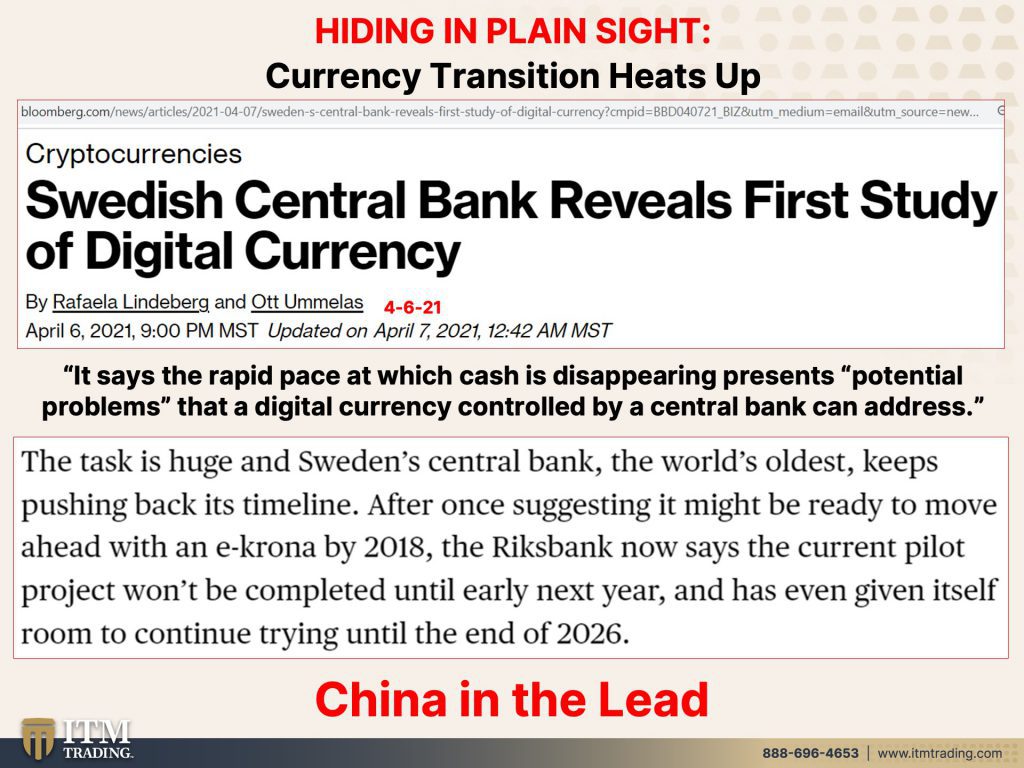

Sweden, known for innovation and with the oldest central bank, became the first country to implement negative interest rates in 2009. Additionally, they are almost cashless and have been aggressively experimenting with the E-krona, their CBDC (Central Bank digital Currency), originally stating it would be ready by 2018. Apparently, they were wrong. In the first study of the digital currency they state that the project may be completed next year, but they have actually given themselves until the end of 2026 to complete their CBDC project. It seems to be more difficult to do for most central banks, but not China.

Related Articles:

- Economic Warfare hidden in plain sight

- What are the Ramifications of Central Bank Digital Currencies? by Lynette Zang

- Jim Rickards Warns America: War On Cash Has Started, Prepare Your Self For Digital Dollar

- Central Bank Digital Currencies, Surveillance Economy, Perth Mint Delivers Chinese Bars, Silver Miner Withholds Production, Hungary Tripled Gold Reserves

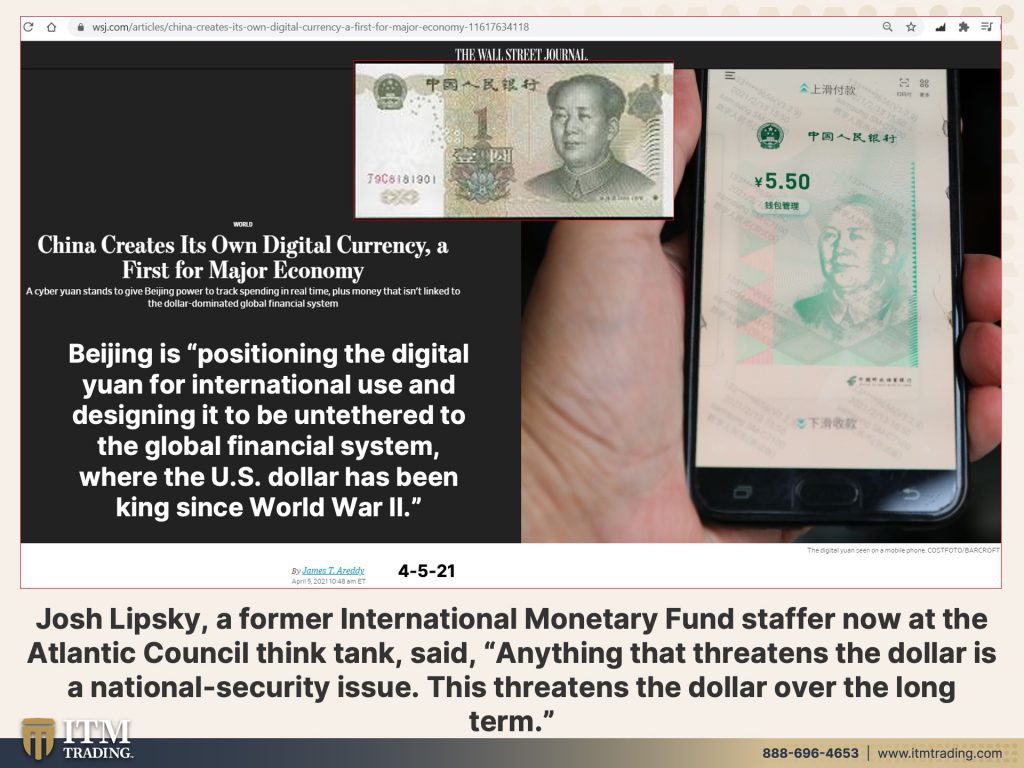

There are clear advantages to having full control over citizens and China seems to take full advantage and has been running their own CBDC pilot programs. When fully implemented, this will be the first for any major economy and will likely position China’s yuan for international use and as direct competition to the US dollar in global trade settlement.

But what I find particularly interesting to watch is how this new digital yuan looks on a phone screen, very much like the paper yuan.

One thing that central bankers know is that if you want to introduce a new currency and a new system, at least initially, keep everything as normal as possible. They’ve had a lot of practice even here in the U.S., moving us from a gold standard that protected its citizens, to a gold backed system, to a debt backed paper system. It is not a coincidence that all those bills look very similar. Nor will it be a coincidence when the Fed issues the digital dollar and its image looks very similar to the paper dollar.

But it seems the transition is heating up and there are signs that the stock market may be breaking down. Will everything be in place when the public becomes aware of the ruse as the fiat markets breakdown?

If you have gold, it will not matter because you hold real money…with no counter party risk.

More on our Blog: https://www.itmtrading.com/blog/hidin…

Podcast: https://anchor.fm/itmtrading

Questions on Protecting Wealth with Gold & Silver? Call 877-410-1414 or Schedule a Call for Later Here: ↓

https://calendly.com/itmtrading/youtu…

_______________

FYI: ITM Trading is comprised of Precious Metals and Economic Experts. We are not financial planners, nor do we do general financial consulting. We are Gold & Silver Strategists. We sell Gold & Silver to Strategic Investors who want to protect their wealth with the proper types, dates, and qualities of precious metals. For more info Call: 877-410-1414

For More Videos and Research Click Here: https://www.ITMTrading.com/Blog

Also, watch us on http://www.brighteon.com

If you have questions to submit for our Q&A Video Series, send them to: Questions@ITMtrading.com

STAY IN THE KNOW!

For Critical Info, Strategies, and Updates Subscribe here: https://www.youtube.com/user/ITMTradi…

If you’re not already in a protected position for the next crisis, call us for your free strategy consult: 877-410-1414

THEN WHAT?

If you want to know what to actually DO about all of this, that’s what we specialize in at ITM Trading. How do you protect your wealth for the next collapse and financial reset?

Yes Gold and Silver, but what types? How much of each? What strategy? And what long term plan?

If you’re asking these questions you’re already ahead of the game…

We’re here to help, as it is our mission to safeguard the public from the inevitable downfall of the dollar, stock markets, and real estate.

We are the most recommended precious metals company in the industry for good reason, because we create lifetime relationships with our clients, and facilitate strategies for lifetime security.

Find out if you’re properly protected today…

ITM TRADING:

Helping Build Your Future, Freedom, and Legacy

Call Today for Your 1st Strategy Session: 877-410-1414

You can also email us at: Services@ITMtrading.com

For Instant Updates and Important News, please follow us on:

All Our Videos and Research: https://www.ITMTrading.com/Blog

Homepage: https://www.ITMTrading.com

ITM Trading Twitter: https://twitter.com/itmtrading

Lynette Zang Twitter: https://twitter.com/itmtrading_zang

Facebook: https://facebook.com/ITMTrading

By ITM Trading’s Lynette Zang

Call Us Direct for Long-Term Gold & Silver Strategies: 877-410-1414

ITM Trading Inc. © Copyright, 1995 – 2021 All Rights Reserved.

Slides

Sources

Slide 1:

Slide 2: N/A

Slide 3: N/A

Slide 4:

https://wqow.com/2021/03/19/g7-suggest-boosting-imf-reserves-to-help-vulnerable-nations/

Slide 5:

Click to access PI2019_11_Italian-public-debt-holdings.pdf

Slide 6: N/A

Slide 7:

Historic 1822 Half Eagle Sold for $8.4 Million in Stack’s Bowers March 2021 Auction

See Full Video Transcript Below

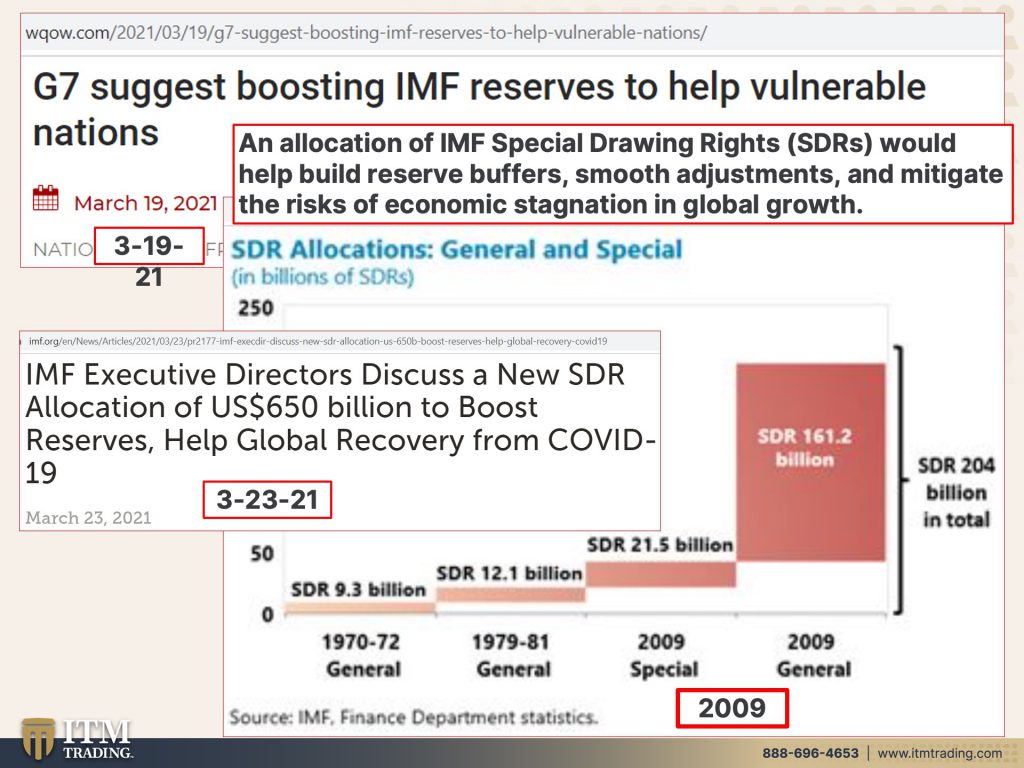

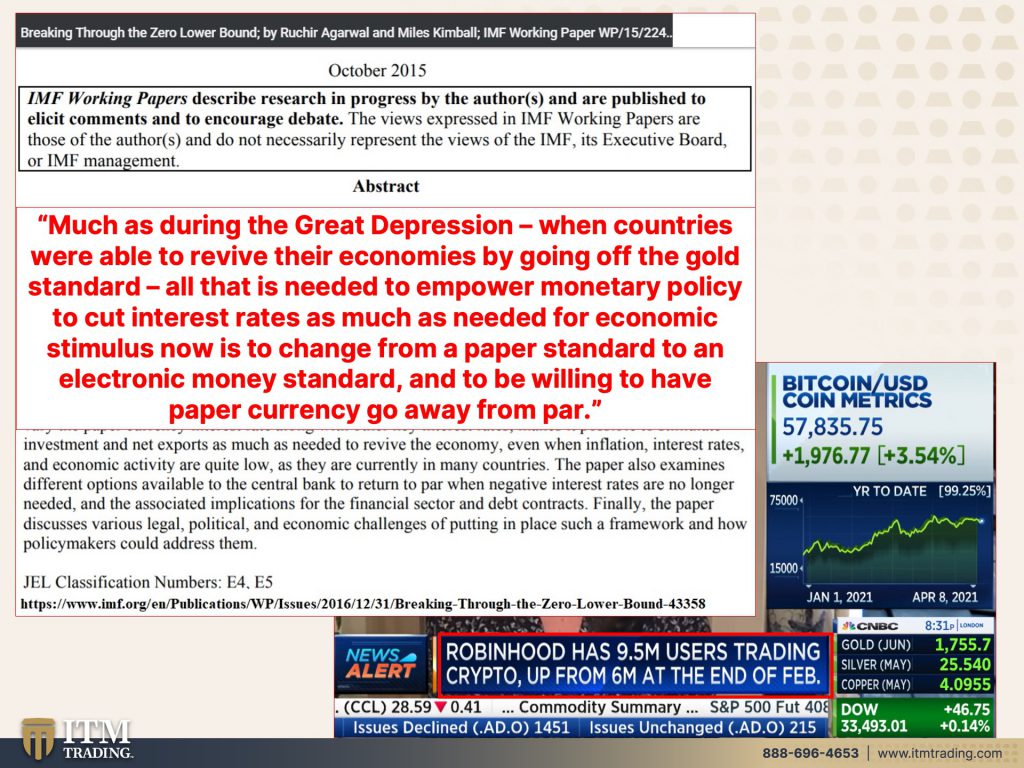

The transition to a digital currency is heating up and I get to do one of my favorite things today which is show you how that happens all that and so much more coming up I’m Lynette Zang chief market analyst here at ITM Trading a full service physical gold and silver dealer and today you know if you don’t hold it you don’t own it I’m going to show you why that is so important because hiding in same in plain sight is the currency transition and it is heating up now interestingly enough Sweden who has the oldest central bank was the first to go to negative rates in 2009 and also is almost virtually cashless so they came out with their or they’ve been working on coming I should say with the e corona the first CBDC and they just did a study and they’re saying that they need to do this because hey when cash goes away well these central bank digital currencies can come in and fill that place and be an awesome thing but the task is huge and the world’s oldest they keep pushing back the timeline so originally they thought they would have this out up and running and everything by 2018. now after this study they’re actually saying well maybe next year but we could take up until 2026 to issue it so there are clearly it’s harder than everybody thought especially if you take the time to do the studies to see the possible probable different impacts that it might have on the population and the currencies not all countries are concerned about that I’m going to come to that in a second because frankly it’s China who’s now in the lead even though Sweden started first and we’ve been talking about this and the fact that China is issuing and has been running a major test on its own CBDC now here’s their c oops I forgot to grab my little laser pointer so here’s their CBDC I just want you to look at that on their on the phone so when somebody goes to spend it that’s what it looks like but Beijing is positioning the digital yuan for international use and designing it to be untethered to the global financial system where the US dollar has been king since world war ii and frankly we’ve been watching the transition and the battle between the east and the west so between China and the US for a number of years this is where frankly they’re way ahead of the US of course they may not cons have as many considerations considering that they’re a totalitarian government they could do anything they want and a full surveillance economy so we know that this is another tool for them to track and control but they’re citizens but it is also a tool to position their yuan also known as the renminbi for you for those of you that hear it both ways as a true international currency which they’ve been trying to do to a certain level of success I mean they are part of the SDR baskets special drawing rights the IMF’s currency but not as quickly or successfully as they would like now here’s where I find it really interesting maybe you do too so this is the paper you want looks pretty similar to the digital you want remember when you want to make a transition you want things to seem as normal as possible so going digital has been in the works really since the 50s since they first introduced the credit cards to the population so you know we’ve been moving in this direction but I want to show you what it looked like in the US because I haven’t done this in a really really long time and I think I have some new viewers and it could make sense to review it because we’ve already heard talk of the digital dollar even though our federal reserve is not yet ready to issue it and what you’re looking at here is a gold certificate so you could convert this into gold and just like Sweden said they’re not taking away cash and China is actually also saying they’re not taking away cash those are just really temporary windows they will end up taking away cash because especially well no all central banks and governments want more direct control over what happens in the economy this 18-month lag time who needs that gosh okay so here is a gold back so this was still the dollar was still partially backed but you know you can see how similar the two of these look right you want to keep it as close to what people are used to as possible and here’s the 1974 20 bill which looks an awful lot like the 1934 gold back versus debt back so once we hit 1971 we were on the paper standard but my point being is that they want to keep it as close to normal as possible because they absolutely know meaning central bankers governments that’s the day that I’m referring to that that they want to make these transitions with your cooperation so they have to keep it as close to normal what you’re used to as possible hence when we do get the CBDC here in the US what are they calling it the digital dollar they marry people marry the legal money of the state I mean I can tell you I was around in July of 1971 and in September of 1971 and I didn’t realize what had changed they didn’t want you to realize it so they try and keep it as close to normal as possible now we talked a little bit about the SDRs for those that are new please forgive me if I’m being redundant but the SDR stands for special drawing rights it’s the currency of the IMF it is composed of a basket of currencies it was created in 1969 to take over as the world reserve currency from the US dollar but when Kissinger went to Saudi Arabia and created the petro dollar that did not need to happen and so it kind of just went to sleep they didn’t break down any of the mechanisms or any of the tools that they had created they just weren’t utilizing them until 2009 that’s when all of that changed and you can see here this is both of these are from 2009 at that point they tested all the systems mechanisms tweaked what they needed to do created the substitution fund that would enable anybody that’s holding dollar assets or dollar instruments like bonds let’s say to make a deposit into the substitution fund and then the IMF could wash it and convert it boom into SDR denominated instruments or assets that would then give the SDR an even bigger global reach that it has right now because it has been used in the system for a long time go to USPS the US postal service and in the search bar put SDR and you’re going to see but they’ve it’s been used it’s been used since it was created in 69 so they didn’t have to reinvent the wheel they merely had to wake that wheel up and tweak it to accommodate a bigger mission I cannot personally tell you that this is absolutely going to be the new world reserve currency but it makes a whole lot of sense to me that it would because where that basket right now is composed of like six different currencies including the yuan and the dollar and the euro and the corona and the British pound etc. they can expand the number of currencies that are in there to include frankly every country so to make it to be universal currency I will say in here though as well that they have indeed discussed putting a component of gold back in the SDR it was originally gold in the SDR but they took that out when the US went off the gold standard so they have indeed talked about putting a component of gold in the SDR which they would need to do to gather confidence and trust in that currency and get the public general public to use it again a look can I guarantee this of course I can’t guarantee this but that is what’s happened a hundred percent of the time because once the public is battered and beaten and bloodied and bruised enough they don’t trust the powers that be they don’t trust these central bankers and trust this is a con game confidence and trust is everything and gold it what is what has historically had the trust and people may say cryptos we’re going to talk a little bit more about that but that has not yet been tested so moving forward the g7 had talked about boosting those IMF reserves and that was in in you know the middle of March pretty much at the same time that the IMF was talking about doing just that now in this valuation you have roughly not even 250 billion SDRs they’re talking about boosting it by 650 billion now what I want to point out when you’re hearing how great the economy is and how quickly it is growing it is growing on mountains of debt nothing grows all the way to the sky there is a day of reckoning that is we are fast approaching and I can’t tell you what’s going to be Tuesday morning at 8 35 but make no mistake about it all they can do is everything that they’ve already done debt debt debt and more debt and leverage so they’re talking about boosting the SDR globally that means that they do create this out of thin air they do not create it from debt and then they give it to all of their member nations okay so here you go here is a concert currency that is that is created truly out of thin air and of course when it is then all the those other currencies that are part of that basket they have to buy those currencies and that strengthens or makes it appear it’s really more of an appearance than a reality clearly but that would be supportive of those different currencies that are inside of this SDR basket because what they’re really talking about doing is more than tripling the allocation then you can go out countries can go out and shop with it they can go out and buy stuff with it you know and by the way this is kind of an aside but you know members of the IMF they don’t pay taxes anywhere and they’re not subject to any laws of any country it’s a great job I should have applied not really because I wouldn’t have fit in very well there but you know what can I tell you sometimes that’s the way these things happen okay something else that is critically important in all of this whole piece where we’re talking about debt and money this is Italy’s debt to GDP going back to the mid-80s okay as we were starting this experiment and this is last year’s right so the debt is exploding who is buying that debt 155.6 percent doesn’t matter that doesn’t matter really well maybe that’s your opinion but that is not my opinion and that that is not what history shows us over and over again Italian and French banks revive the doom loop fares with bond buying because somebody and we’re doing the same thing I mean I love how fingers get pointed but nobody ever seems to look in the mirror the federal reserve has been buying us government debt since I believe it was December 18th of 2002 I know it was 2002. I might be and I know it was December maybe it was the 23rd but we’re like right in there but hey France and Italy is doing that now why would they have to because there are not enough buyers of the debt and that creates a doom loop right in this particular case what they are referring to is the government loaning the bank’s money to buy the government bonds so that the government can continue to spend there’s that doom loop but I didn’t put it in this one but I’ve shown you many times and the Bank of Canada does a stud an annual study now on government bond defaults sovereign debt defaults and in advanced economies like the euro is an advanced economy or the Eurozone is an advanced economy you know really this is what third world countries used to do so now you have all of this debt and the more debt that the government issues the less value that it all has but they give them the money so it just keeps going and going when this time bomb explodes it’s taking everybody and everything with it so Banca d’Italia said the share of the country’s government bonds owned by foreign investors dropped the first six months of last year from 25.9 to 23.6 uh-oh fewer buyers mean that the banks have to step up to the plate and be buying Italian banks are by far the largest source of finance for the Italian government my guess is because they can they can hide things this way or that way but my guess is that would be true in many many many many many many places including the US even though that’s not what they make it look like but since Italy does not control its own money supply right it doesn’t have the lira anymore she cannot print money to meet these debts nor can she devalue her currency to boost her economy right so that’s the currency wars if my currency gets cheaper against your currency then it means that my products are better priced in your country so therefore more people will buy those imported products so we’ve been dealing with that for many years the currency wars but who really pays the price in the end I have to say it’s always the public that does it in this particular case where you’re where you’ve got and not just in Italy and France but I’m really referring more to the doom loop where the central banks are buying government debt because there’s not enough buyers of it and therefore they have more debt to service with which then makes it harder for them to stimulate the economy and so they take on more debt and they sell it to the banks see how it just goes around everybody is doing this and it will be the public that ends up paying the price those that stay in those fiat money products and are not truly diversified and are not truly protected and you really need to keep that in mind and I wanted to bring this full service or full circle back to the IMF and my favorite piece that they’ve done to date 2015’s breaking below the lower zero bound let’s make sure that we have that link in there Edgar please because right in the beginning they lay it out and whether you think oh that was 2015 this is 2020 21. these things take time they take time and how convenient the digital adoption how convenient many things have happened much as much as during the great depression when countries were able to revive their economies by going off the gold standard which now officially there’s three cents left out of the original dollars worth of purchasing power woo hoo that’s really reviving the economy isn’t it is it reviving your economy this is the stuff that just really ticks me off so much all that is needed to empower monetary policy central banks to cut interest rates as much as needed for economic stimulation in other words getting you to spend money let’s see is now is to change from a paper standard to an electronic money standard and be willing to have paper currency go away from par in other words the face value of that bill may be twenty dollars but by the time you spend it maybe you only are getting three cents worth of purchasing power I mean frankly that’s what that’s really what’s been happening but this would be obvious it’s not I’m sorry not the purchasing power it’s actually the principle that you end up with out of that 20 bill when you go to use it maybe you only end up with 16 and not because so you got a double whammy because you got the loss of purchasing power no matter what but now because there’s virtually no purchasing power left they have to attack principal that’s what negative rates are about and if you were looking at your bank account and you saw your principal decline and you knew you were not spending that money what are you likely to do you are likely to go out and shop and try to find anything that will hold its value better than the currency so let’s see how could we get how could the central banks get us used to that well let’s see we’ve got huge adoption and we know there’s been a big push since bitcoin came out in 2009 in that was in January and in March is when the central bank started quantitative easing but now with all of this free stimulus money extra unemployment business benefits the extra checks that are going into all of these households robin has 9.5 million users trading crypto now does that really seem like a safe store for you really want day traders trading your money what you’re working for but it is getting adoption it is getting people used to it is getting the world comfortable with it the end of February here we are a little bit more than a month it jumped from six million users or traders of cryptos to 9.5 almost well not really doubling but another 50 percent more or so more than that yep that’s how you get that adoption it’s how you do it you get things you make it and you normalize it you keep everything as close to normal as possible how do you catch a wild boar right you put out some food in the field you don’t touch it the border come eats it and then after about a week or so of that you put up a fence one side of a fence well the wild boar stays away for a minute because it’s something different they’re not comfortable with it but if you keep putting that food out there and you don’t do anything with that one-sided fence they start to come back and eat once they’re comfortable with that you put the next side of the fence up and again they stay away because there’s something that has changed they’re not comfortable with it but you keep putting the food out they come and eat you put up that third side same thing and then when they’re comfortable with all three sides and they’re in there eating that food that free flipping food bam you put that fourth side down and you have captured wild hogs don’t be a wild hog I mean seriously don’t be a wild hog because there is one form of real money that has been proven through time to hold its value and then some and so many people talk to me and they’re just about the weight of the medal and in some cases that’s really all you want like for property taxes or medical conditions and things like that that’s really the kind of thing that you want but you want to do it in the way that is most likely to be able to survive this mess I got a question the other day about well somebody had said that well all they’d have to do is tax the gold at 90 percent and then they wouldn’t have to confiscate but this particular coin is a five dollar gold coin so roughly a quarter of an ounce roughly and it sold for 8.4 million dollars let’s see who do you think can afford 8.4 million dollars for a quarter of an ounce of gold probably somebody really wealthy probably somebody that either writes the laws or has the ability to influence those that write the laws so maybe they would do that with monetary gold because monetary gold is 98 of all the gold that’s above ground so that’s new stuff but with this old stuff do you really think that those that write the laws or those that can afford to spend 8.4 million dollars on even an ounce of gold they going to pay 90 percent don’t think so a big reason you know aside from growing up and watching my uncle al who was able to accumulate legally thousands of ounces of gold when nobody could hold more than five right but he did it the legal way and understanding how the wealthy set these rules for themselves what do you think because if you don’t think that cryptocurrencies are a threat to the us dollar and to these sovereign currencies the Chinese yuan et cetera think again they’re not going to let it just happen it’ll be a small part I’m not saying they’re going away but they’re not going to let they’re not going to give up their money monopoly and if you’re working with people if you’re in the same category you have to spend 8.4 million on a gold coin but you want to be I want to be you do whatever you want I want to be in the same category as the person that bought this coin because if I am I have a much better shot of holding on to my wealth and having the ability to utilize it as we continue through this transition and through this reset of the economy the financial system and the monetary system that’s what I want absolutely this is what’s proven that’s where I’m comfortable whatever else you do and you have to do what you want to do and what you’re comfortable with no matter what anybody says including me you have to do that for yourself just please make sure that you have a properly diversified and balanced portfolio if everything you have is intangible then it’s not a balanced portfolio I don’t care if it’s cryptocurrencies or it’s stocks or bonds or ETFs or REITs or any of that garbage or annuities or or any of that because none of that wealth is hard tangible now real estate is that’s a tangible hey I’m inside a real estate right now and it looks like I’m finally getting the bug-out house that I’ve been working on for so long thanks to Megan in very large part what a great job she’s done I got to give her some kudos because she worked hard on that but how liquid is that right whereas if you have a properly diversified even metals portfolio you have some pure asset protection so emergency gold would go into that you know emergency silver but again it’s that price discrepancy so you can hold a lot more wealth in the same size package with gold as you can with silver okay so you have some that is purely asset protection you have some that is purely for growth you have some gold you have some silver and you have all the pieces and parts along the way so that no matter what function you are trying to perform voila you have instant liquidity to handle any of it and again I cannot stress this too much you know people can call me crazy and hey I’m used to it I’ve gone crazy probably pretty much all my life if you want to know the truth but if I could be like if I could buy the retirement plan or the health care plan that our government has for themselves up at the senate where I should say in the congress then I would do it and if it cost me a premium to do it I’d still do it because it’s a much better plan than Social Security and Medicare that’s what this is this is your monetary best plan because of who’s in it so make sure that for behind the scenes and updates just go ahead and follow me on Instagram at lynettezang Twitter at Lynette at ITM Trading underscore zang and I think do you have all of these up on the all of that and again I hope you’re enjoying the podcast I actually some of you if you’ve been watching me for a really really really really long time then you know every once in a while I do a little poetry but I’ve recently been getting into that more and I’m actually probably going to do some of that on the podcast I’d like to I’d like to it’s fun for me and hopefully it’ll be fun for you just a little bit of lightness and all of this really nasty stuff so we’re on Spotify apple podcast google podcast anchor breaker and even more thank you so much boy you know you know how nice it is when you have these wonderful people around you that do such good work you met you know you met Lindsay yesterday you’ll meet Laura in the future and of course you hear me talk to Jacqueline and Megan and you know I am such such a lucky woman to be surrounded by these wonderfully talented people that help me look better than maybe I would look without them to be perfectly honest with you so that is it for today it is definitely time to cover your assets things are insane out there and nobody’s going to know when this music stops but when it does have your gold physical and silver physical in your possession no counterparty risk safest thing that you can do and until next we meet please be safe out there bye

Disclaimer:

This article is solely for informational purposes only and it should not be construed as a solicitation or offer to buy or sell on any financial securities/instruments, etc. nor anyone should take the content as an investment advise, any opinion expressed in this article are subject to change without prior notice, eurymanthus.wordpress.com and its author is under no obligation to keep current of the information herein and accepts no liabilities for any gains, losses of any kind arising from any of the material presented on any post/s and/or article/s published.

Trade At Your Own Risks

Archive posts

2 thoughts on “Hiding in Plain Sight: Currency Transition Heats Up by Lynette Zang”